In 2024, digital transformation in the banking sector has accelerated, fueled by artificial intelligence (AI) solutions that meet the evolving demands of modern customers. One standout innovation in banking support is AiSA-X, an advanced AI-powered support assistant designed to provide seamless, secure, and efficient customer service. This blog will explore how AiSA-X serves as a dedicated banking support agent, enhancing customer satisfaction, streamlining operations, and enabling banks to manage a higher volume of queries without compromising service quality.

Table Of Contents

- 0.1 1. Round-the-Clock, Multi-Channel Support

- 0.2 2.Superior Natural Language Understanding (NLU)

- 0.3 3. Data Privacy and Security Standards

- 0.4 4. Integration with Banking Systems

- 0.5 5. Proactive Customer Engagement

- 0.6 6.Cost Savings and Improved Efficiency

- 0.7 7. Use Cases for AiSA-X in Banking

- 0.8 Conclusion

- 1 Venkateshkumar S

1. Round-the-Clock, Multi-Channel Support

Today’s banking customers expect immediate assistance, regardless of the time of day. A 2024 survey reveals that over 80% of banking customers prefer 24/7 customer support , a demand that traditional support agents struggle to meet. AiSA-X, however, operates around the clock, providing instant responses across multiple channels, including mobile apps, websites, and social media. Whether a customer needs help with a balance check or initiating a loan application, AiSA-X is available at any hour.

With its 24/7 availability, banks can significantly increase customer engagement. The assistant is also multilingual, enabling banks to cater to diverse customer bases across different regions, enhancing the overall user experience with consistent, high-quality support.

2.Superior Natural Language Understanding (NLU)

AiSA-X’s advanced Natural Language Understanding (NLU) capabilities allow it to handle even the most complex banking-related queries. Studies in 2024 show that over 70% of customer interactions in banking involve complex information requests. Traditional chatbots often struggle with financial jargon or nuanced inquiries, leading to customer frustration. AiSA-X’s NLU capabilities solve this by interpreting complex requests with high accuracy, enabling context-aware responses that closely mimic human assistance.

For example, if a customer asks about loan eligibility, AiSA-X can assess the query, provide relevant product information, and guide the customer through basic eligibility checks, creating a smooth and frustration-free experience.

3. Data Privacy and Security Standards

With customer data privacy at an all-time high, AiSA-X prioritizes secure, encrypted data processing and compliance with industry standards like GDPR and PCI-DSS. A recent survey highlights that 60% of banking customers cite data privacy and security as a top concern. AiSA-X’s data management protocols reassure customers that their information is protected and ensure that banks remain compliant with regulatory requirements, minimizing data breach risks.

This focus on security positions AiSA-X as a trusted assistant capable of handling sensitive banking information, from personal identification details to transaction data, bolstering trust and customer confidence.

4. Integration with Banking Systems

AiSA-X integrates seamlessly with existing banking systems, which helps reduce operational costs and enhances efficiency. Research shows that integrating AI into customer support can reduce costs by up to 30%. AiSA-X connects directly to CRM, transaction systems, and document management software, reducing the need for human intervention in repetitive tasks.

For instance, if a customer wants to check recent transactions, AiSA-X can instantly pull up relevant information. This integration streamlines customer support, freeing up human agents to handle complex, high-touch interactions that require empathy and expertise.

5. Proactive Customer Engagement

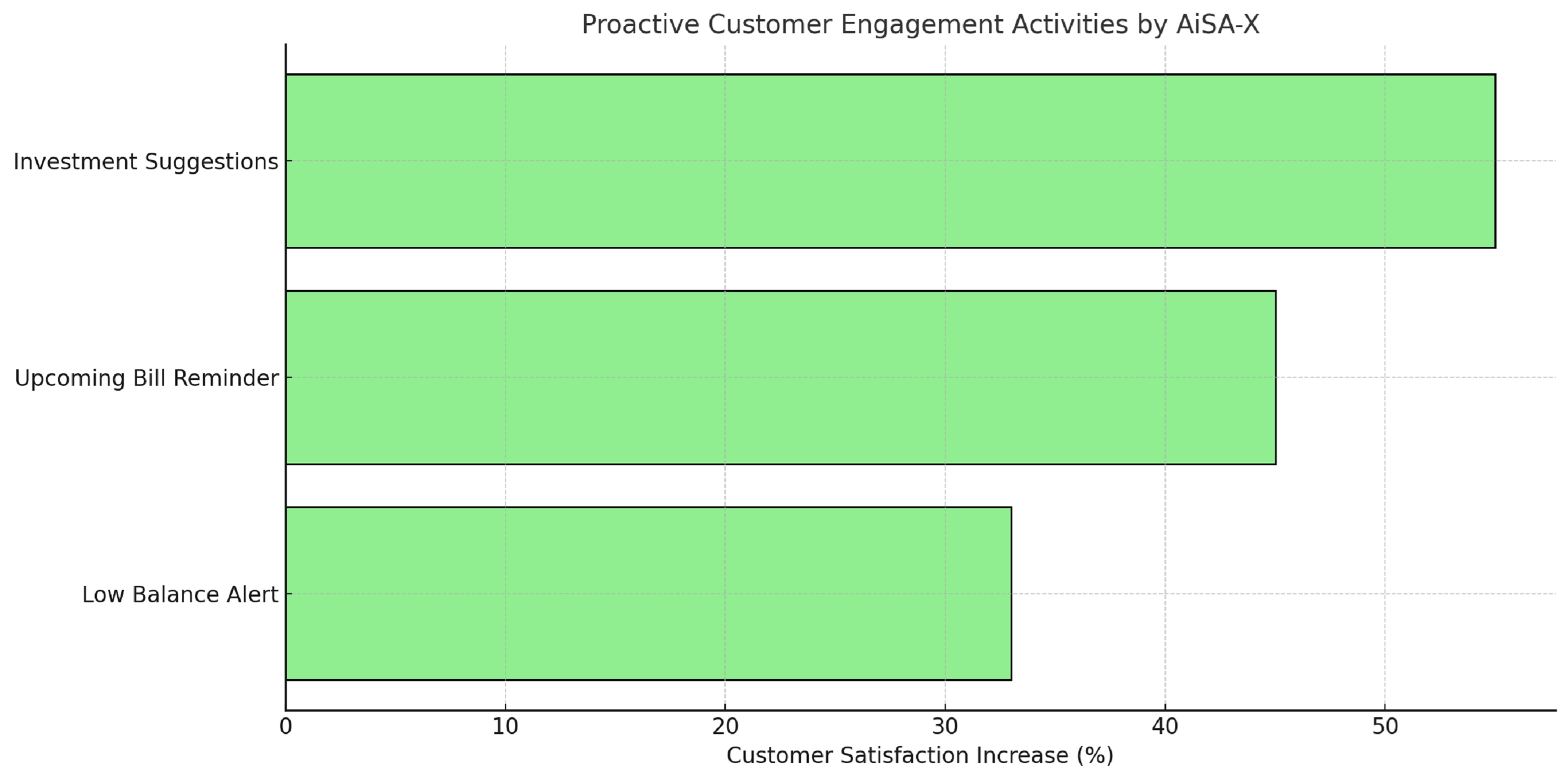

AiSA-X doesn’t wait for customers to ask for help; it proactively engages with them, enhancing the banking experience by anticipating needs and providing timely guidance. Data shows that customer satisfaction increases by 33% with proactive support. AiSA-X can send alerts about upcoming bill payments, low balances, or even suggest investment options based on transaction history, making customers feel more supported.

Through personalized, proactive engagement, AiSA-X helps banks exceed customer expectations, fostering loyalty and strengthening brand reputation.

6.Cost Savings and Improved Efficiency

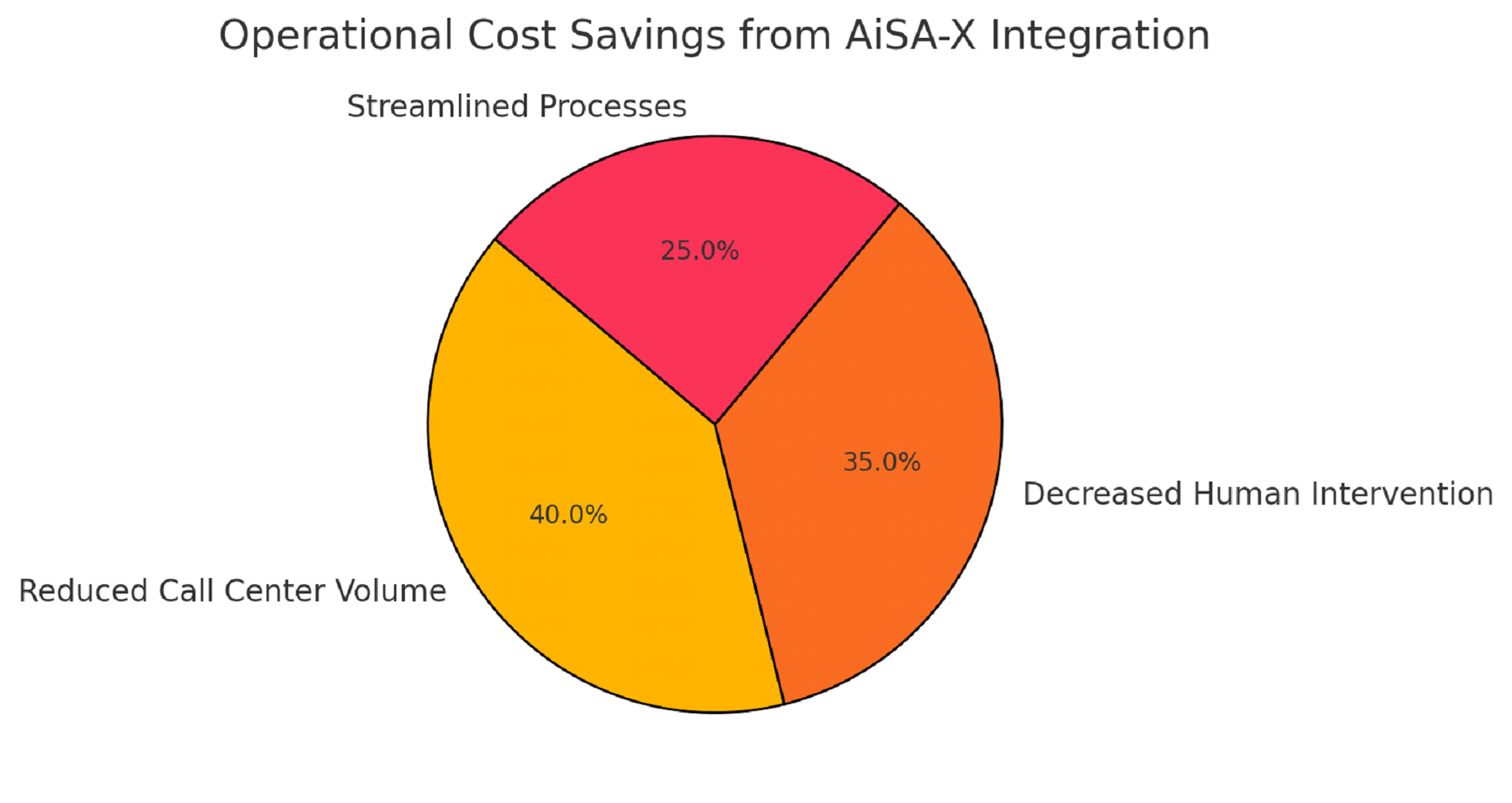

Reducing costs is a primary driver for adopting AI in banking support. Recent reports show that banks using AI experience a 25% reduction in call center volume, leading to lower operational costs and increased productivity. AiSA-X handles routine inquiries—such as balance checks and password resets—allowing human resources to focus on complex issues that require in-depth knowledge.

In addition to cost savings, AiSA-X improves response times, which is critical for maintaining customer trust. By automating repetitive tasks, AiSA-X optimizes resources and boosts productivity, allowing banks to serve more customers efficiently.

7. Use Cases for AiSA-X in Banking

AiSA-X is versatile and can address a range of support needs within a bank. Here are some real-life applications:

- Loan Application Assistance: AiSA-X can guide customers through the loan application process, from checking eligibility to explaining documentation requirements. This minimizes wait times and frees up human agents for high-priority tasks.

- Transaction Monitoring: Customers can inquire about recent transactions, download statements, or check transaction details with AiSA-X’s real-time responses, reducing the need for live support.

- Fraud Prevention: AiSA-X can monitor account activity for suspicious transactions, providing immediate options for account freezes or escalation, protecting customer funds and reinforcing trust.

Conclusion

As the banking sector evolves, AI-powered support solutions like AiSA-X set new standards for customer service. With instant, secure, and proactive support, AiSA-X enables banks to meet high customer expectations while reducing operational costs and improving productivity. From handling routine transactions to providing personalized financial advice, AiSA-X offers a comprehensive, intelligent solution that helps banks stay competitive in today’s fast-paced digital landscape.

By adopting AiSA-X, banks can deliver a seamless, efficient, and secure customer experience that fosters loyalty and improves customer satisfaction. AiSA-X is more than a support assistant—it’s a strategic partner in transforming the future of banking.

ABOUT AUTHOR

Venkateshkumar S

Full-stack Developer

“Started his professional career from an AI Startup, Venkatesh has vast experience in Artificial Intelligence and Full Stack Development. He loves to explore the innovation ecosystem and present technological advancements in simple words to his readers. Venkatesh is based in Madurai.”